30+ Debt to income ratio for house

Ad Call for a refi instead. To this point the Consumer Financial Protection Bureau defined debt-to-income ratio as the total of monthly debt payments divided by gross monthly income.

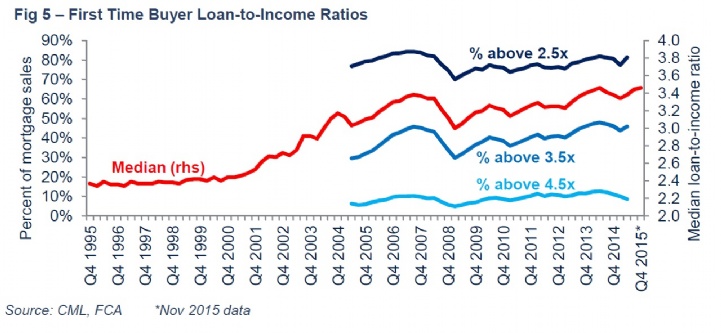

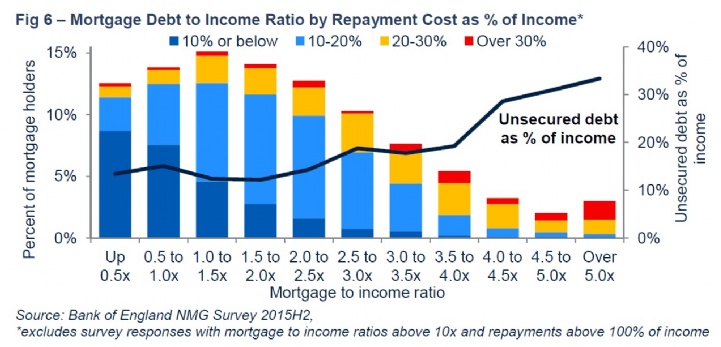

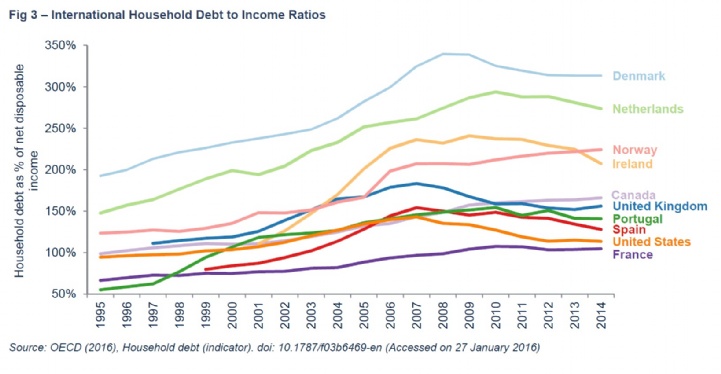

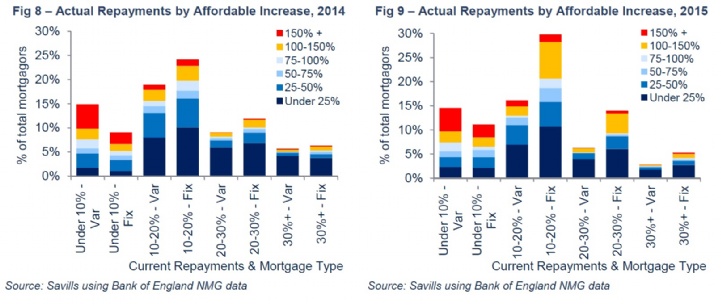

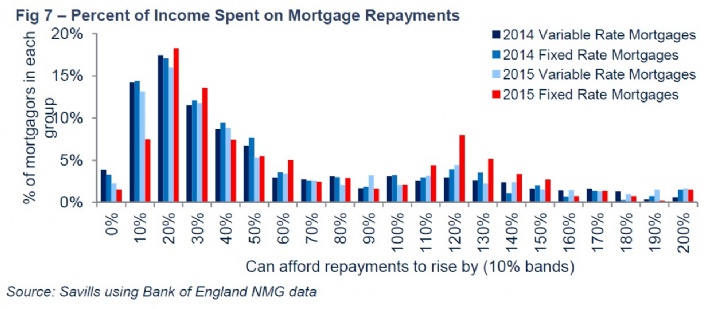

Savills Household Debt

Prepare all documents needed for your application.

. For example lets say your debt. What is the highest debt-to-income ratio to buy a house. If a lender has to chase you up for multiple missing documents it can slow down the application process.

Calculate Your Monthly Loan Payment. Answer Simple Questions See Personalized Results with our VA Loan Calculator. For example if your total monthly debts.

The calculator also allows the user to select from debt-to-income ratios between 10 to 50 in increments of 5. See If Youre Eligible for a 0 Down Payment. If coupled with down payments less.

Ad Call for a refi instead. Calculate your DTI by dividing your total monthly debt payments by your total monthly gross income your income before taxes. Get A Home Equity For The Best Rates.

Top Lenders Reviewed By Industry Experts. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. The debt-to-income DTI ratio measures the amount of income a person or organization.

Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI. Ad Find Out How Much You Can Afford to Borrow. When it comes to DTI the lower the ratio the better Ulzheimer says.

As a quick example if. The back-end DTI ratio shows the income percentage covering all your monthly debts. Compare Mortgage Rates Estimated Monthly Payments from Multiple Lenders.

It means you can take on new debt more easily because you have the capacity to make the payments. To be eligible youll need to document at. Comments sorted by Best Top New Controversial QA Add a Comment.

Try Our Customized Mortgage Calculator Today. With FHA you may qualify for a mortgage with a DTI as high as 50. FHA Debt to Income Ratio Requirements.

Ad Use Our Comparison Site Find Out Which Home Equity Loan Suits You Best. A high debt-to-income ratio can be an indication of financial trouble ahead even if you seem to be easily managing your payments right now. Skip The Bank Save.

A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly. A more prudent DTI ratio is specified in the 2836 rule which dictates that you should not spend more than 28 of your gross income on housing and a maximum of 36 on. It is calculated by adding up your total monthly bills such as your credit card debt payments.

The debt-to-income ratio will be displayed as a percentage. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. Your Property Is Worth More Than You Think.

Can you buy a house if your debt-to-income ratio is high. Find The Best Home Equity Rates. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

More posts you may like. When you divide the monthly payments by the gross monthly income the result you get will be a decimal. The debt-to-income ratio will be displayed as a percentage.

Pin On Best Of One Mama S Daily Drama

What Bills Are Calculated In The Debt To Income Ratio Quora

Savills Household Debt

Savills Household Debt

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Savills Household Debt

Pin On Life After College

.jpg)

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

America S Total Debt Report Page 2 By Mwhodges

.jpg)

Savills Household Debt

What Is The Debt To Income Ratio And Why Is It Important Quora

Business Balance Sheet Template Free Download Balance Sheet Template Statement Template Business Letter Template

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

When Banks Evaluate My Debt To Income Ratio Is Income Accounted For The Gross Revenue I Bring In From Work Or Net Income After All My Living Expenses Quora

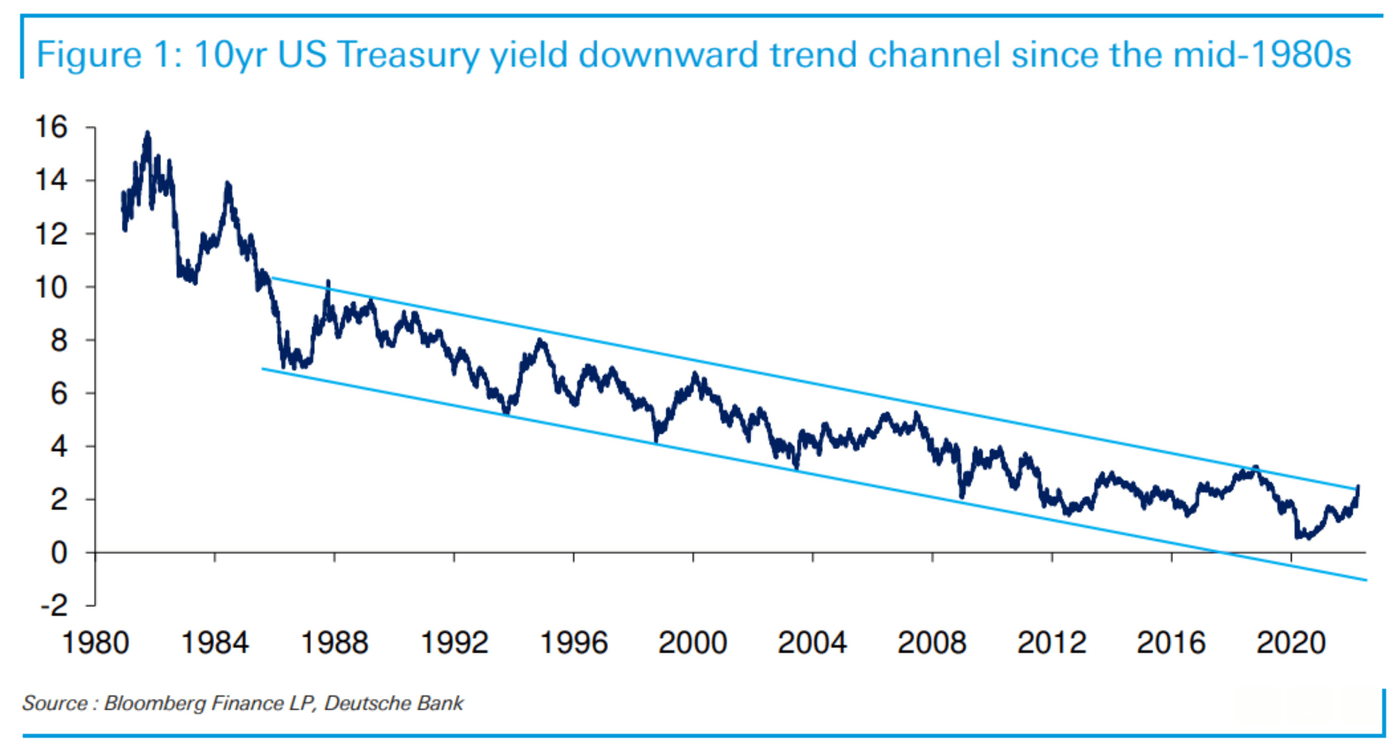

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm